Acknowledgement of Country

The James Martin Institute for Public Policy acknowledges the Gadigal people of the Eora Nation upon whose ancestral lands our Institute stands. We pay respect to Elders both past and present, acknowledging them as the traditional custodians of knowledge for these lands. We celebrate the diversity of Aboriginal peoples and their ongoing cultures and connections to the lands and waters of NSW.

About the author

Dr Angela Cummine is JMI’s inaugural Senior Policy Fellow. She joined the Institute from July to August 2022, on temporary leave from her role as Director, Sustainable Finance at NSW Treasury.

Angela is an experienced senior executive, book author and adviser on democratic public wealth management and sustainability. She joined NSW Treasury in 2018 having led the cross-government team that designed and established the NSW Generations Fund (NGF), today a $14bn sovereign wealth fund, as one of the central pillars of the 2018 State Budget. Angela’s sustainable finance role involves driving a coordinated and strategic approach to sustainability risks and opportunities that impact the State’s balance sheet, including climate and Environmental, Social and Governance (ESG) risks.

Angela received her doctorate in political philosophy from University of Oxford, on a Rhodes Scholarship. Her book, Citizens’ Wealth, published by Yale University Press, won the 2017 Choice Award for Outstanding Academic Title. Her research undertaken as a British Academy Postdoctoral Fellow at the University of Oxford was rated as internationally leading when submitted in the UK’s 2021 Research Excellence Framework exercise.

Angela has published her research in both peer reviewed and media outlets, and advised a range of government, international and financial institutions on citizen-centric sovereign fund design, and public wealth governance. She holds a M.Phil in Political Theory from University of Oxford, BA LLB from Sydney University (First Class Honours) and a Statement of Attainment from Western Sydney University in climate risk management.

The sustainability impact of government financial activities is of intensifying interest to financial market participants, regulators and communities. Governments – as investors, issuers, regulators, procurers and owners – are under growing pressure to become more sustainable financial entities. Legal and accounting standards are evolving to require disclosure of climate and other sustainability risks, as well as evidence of feasible action to support targets and commitments. At the same time, stakeholders such as investors, rating agencies and communities, increasingly expect a consistent whole-of-government (WoG) approach to Environmental, Social and Governance (ESG) risks and opportunities.

Governments – as investors, issuers, regulators, procurers and owners – are under growing pressure to become more sustainable financial entities.

Against this backdrop, this ‘At a Glance’ report considers in brief, and a full accompanying report examines in depth, whether sovereigns should report and disclose on sustainability-related actions and if so, how. Public sector sustainability reporting is in its infancy. Reporting is time-consuming and costly and if it seeks to serve too many masters, it can end up serving none. The sustainability sector is under increasing scrutiny with concerns about greenwashing, where ESG credentials can be exaggerated for marketing purposes. In this climate, the role of governments has come into focus – should they simply regulate the private sector and legislate to entrench a common set of reporting standards for the market, or should they also publicly report and disclose their own sustainability impacts? This report argues that sovereigns should be producing a WoG sustainability report and making sustainability disclosures at the WoG level. That is, governments should produce a singular, aggregated view of the sustainability impacts of their public sector and the jurisdiction over which it is sovereign. Given the growing demand for meaningful, reliable sustainability data from financial, political, industry and community stakeholders, proactive public reporting on sustainability actions could help governments protect their sovereign credit ratings, borrowing capacity, public wealth returns and social license with communities.

This WoG level reporting can supplement individual agency or department level sustainability reporting where it exists. At a minimum, this would include an integrated view of the sustainability impact of a government’s own operations on the community it serves and may extend to include a state-wide view on certain topics. For instance, understanding a state’s climate risk exposure will be a more meaningful indicator of a sovereign’s exposure to physical and transition risk than a narrowly focussed analysis on public sector climate risk. A state-wide view would also recognise the interconnectedness of many sustainability issues. New international standards have recognised that climate risk must include discussion of just transition and nature.

Yet, little precedent exists for public sector entities on standardised best practice sustainability reporting and disclosure. Of a multitude of frameworks available for sustainability reporting, very few deal exclusively with the public sector – although that is set to change. Of the existing standards, most cover the private sector.

In Australia, there is currently no national approach to sustainability reporting for the private or public sector. This has led to a proliferation of approaches by individual Australian governments and industry bodies on a wide range of sustainability reporting topics.

Crucially, 2022 has witnessed rapid evolution in sustainability reporting and disclosure practice guidance. 1 Bodies like the International Financial Reporting Standards (IFRS) Foundation’s newly established International Standards Sustainability Board (ISSB) and the Taskforce on Climate-Related Financial Disclosures (TCFD) have moved to develop globally accepted standards for climate-related reporting and other sustainability topics. These initiatives are private sector-led and focussed. While they may offer some guidance to sovereigns, they are explicitly corporate-oriented in their focus, terminology and content.

Proactive public reporting on sustainability actions could help governments protect their sovereign credit ratings, borrowing capacity, public wealth returns and social license with communities.

The International Public Sector Accounting Standards Board (IPSASB) has also launched a consultation process on the development of global public sector specific sustainability reporting guidance and confirmed it will pilot the development of a dedicated sustainability reporting framework for the public sector. While a welcome development for sovereigns, many jurisdictions, including Australia, do not follow the existing IPSASB international public sector accounting standards. This will leave many governments, including state-level governments like NSW, without a customised and clear approach for how to meet the specific needs of their unique stakeholder universe.

This report addresses that gap by suggesting practical steps and proposing a draft template for the NSW Government – and other Australian governments – to commence sustainability reporting and disclosure. The report’s recommendations are addressed to the NSW Government, although they are largely applicable to other Australian governments, and sovereigns abroad. Where necessary, Australia-wide recommendations are identified.

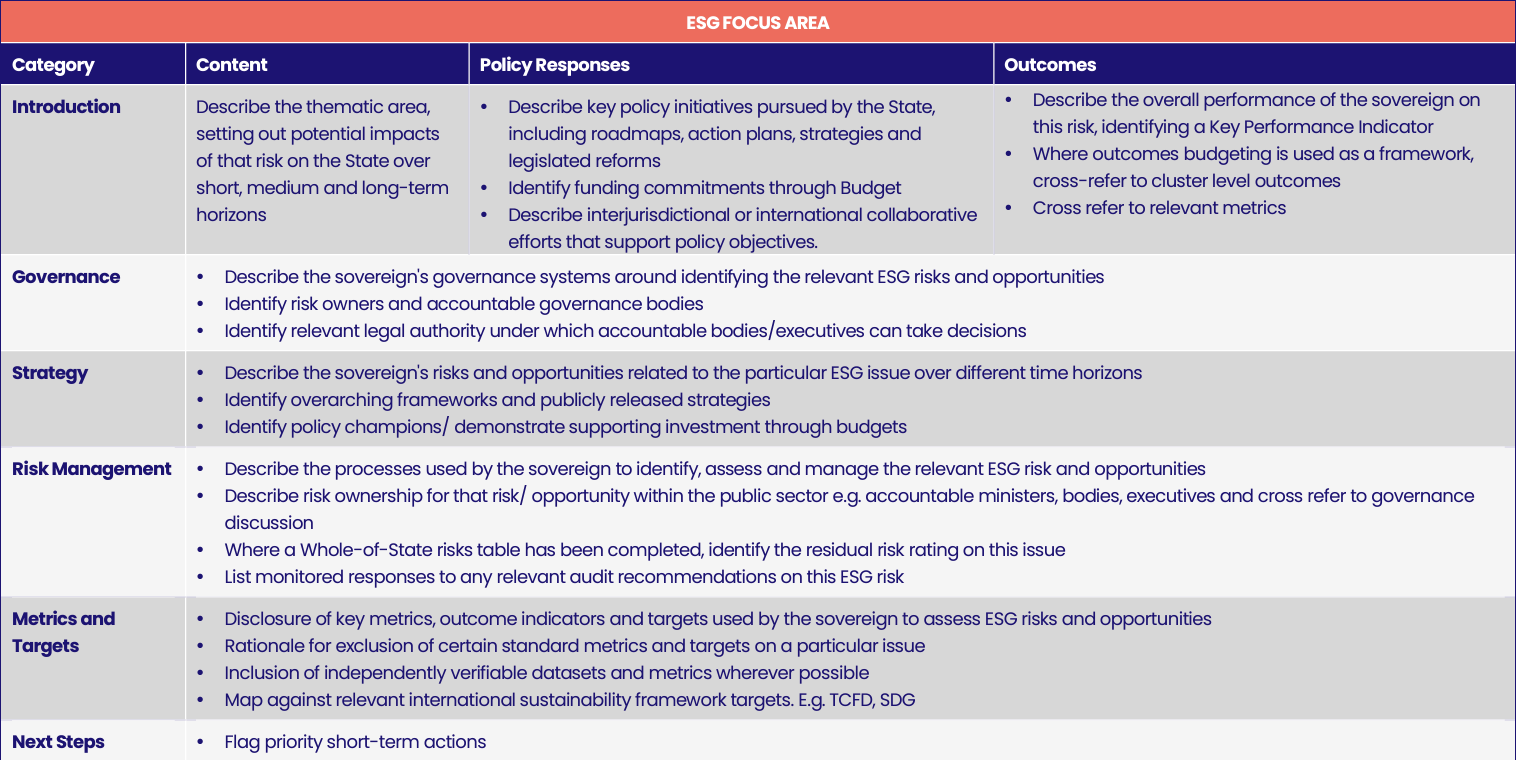

Part 1 of the report considers this preliminary question of why governments should report and disclose on sustainability. It examines the distinct drivers for public sectors to be transparent about their sustainability impact and how they are managing those risks and leveraging opportunities. Part 2 turns to the “how” question. The report recommends the NSW Government initially target financial market stakeholders through their sustainability reports, with NSW Treasury coordinating the product on a WoG basis. After a review of the state of public sector sustainability reporting, and emerging guidance at the international and domestic level, the report proposes a template for Australian governments looking to commence sustainability reporting. The proposed template recommends a double materiality approach, whereby the NSW Government reflects ESG impacts on its financial performance and service delivery, as well as accounts for its influence on sustainability matters.

Particular focus is given to the appropriate objective, scope, content and form of state-level reports, using Queensland and Western Australia’s inaugural sustainability and ESG reports as a case study. In 2021, Queensland and WA became the first Australian jurisdictions to release dedicated sustainability/ESG reports for financial market stakeholders, providing a basis for reflecting on appropriate ESG content and structure for sub-national government reporting. In December 2022, Queensland released a second Queensland Sustainability Report (QSR) which commenced alignment with international standards in the areas of governance, strategy, risk management, and metrics and targets. The QSR 2022 offers a helpful example of performance-based WoG reporting against an established baseline.

This report recommends that NSW and other Australian governments similarly commence whole-of-government sustainability reporting, with sequenced disclosures, building up maturity and data over time. In doing so, NSW should be ambitious by moving beyond the pure policy mapping seen in peer inaugural reports and aim to produce a baseline for ESG performance that embraces a double materiality approach against which outcomes can be tracked over time.

1) Guidance for government sustainability reporting must be customised to reflect the public sector’s distinct roles and unique stakeholder universe

Governments act in financial markets, as investors, borrowers and rated entities, and achieve policy outcomes on behalf of their communities. In pursuing these ends, public sector entities have sustainability impacts through their own operations, by pursuing policy objectives, and as a regulator, standard-setter and market signaller 2. This broad range of roles distinguishes sovereigns from corporates and entails a larger universe of potential stakeholders. Financial market participants (investors and rating agencies) use different metrics and criteria to evaluate the ESG performance of a sovereign as opposed to private sector entities. Moreover, some frameworks for sustainability reporting focus on corporate concepts, such as “enterprise value”, that do not easily translate to a public sector context. Indeed, the breadth of sovereign accountability obligations beyond shareholders “will result in a different focus in the sustainability-related information users want from a public sector entity”. 3 Accordingly, governments require a customised reporting and disclosure approach to meaningfully address sovereign sustainability risks and opportunities.

2) Australian governments should commence sustainability reporting and disclosure as soon as feasible, initially targeting financial market stakeholders, and build maturity gradually

International standards for sustainability reporting and disclosures are evolving rapidly, with multiple consultation processes underway, including for the public sector. 4 In Australia, the Financial Reporting Council (FRC), the Australian Accounting Standards Board (AASB) and the Auditing and Assurance Standards Board (AUASB) published a Position Statement in November 2021 announcing the AASB’s intention to develop a reporting requirements framework for sustainability-related matters in Australia and the AUASB’s intention to update relevant assurance standards simultaneously. The AASB and AUASB have indicated that Australia-specific sustainability guidance for the public sector will follow guidance for the private sector. 5

Governments (national and state/territory) should not delay sustainability reporting while these processes resolve given the urgent stakeholder demand and potentially material consequences of failing to communicate action on ESG issues. Indeed, sovereigns should identify and communicate their ESG risks, opportunities and management approaches to help mitigate negative funding impacts, attract investment for pressing transition and social needs, and build capacity to support growing reporting, transparency and disclosure expectations.

Initial reporting content should align as much as practicable with emerging norms in the standard-setting processes of the ISSB, IPSASB and the AASB, with each jurisdiction prioritising content for inaugural reports in consultation with their key stakeholders. This will allow public sector entities to gradually build reporting and disclosure maturity, consistent with the ISSB’s intention that IFRS Sustainability Disclosure Standards serve as “a minimum set of requirements upon which jurisdictions can build”. 6

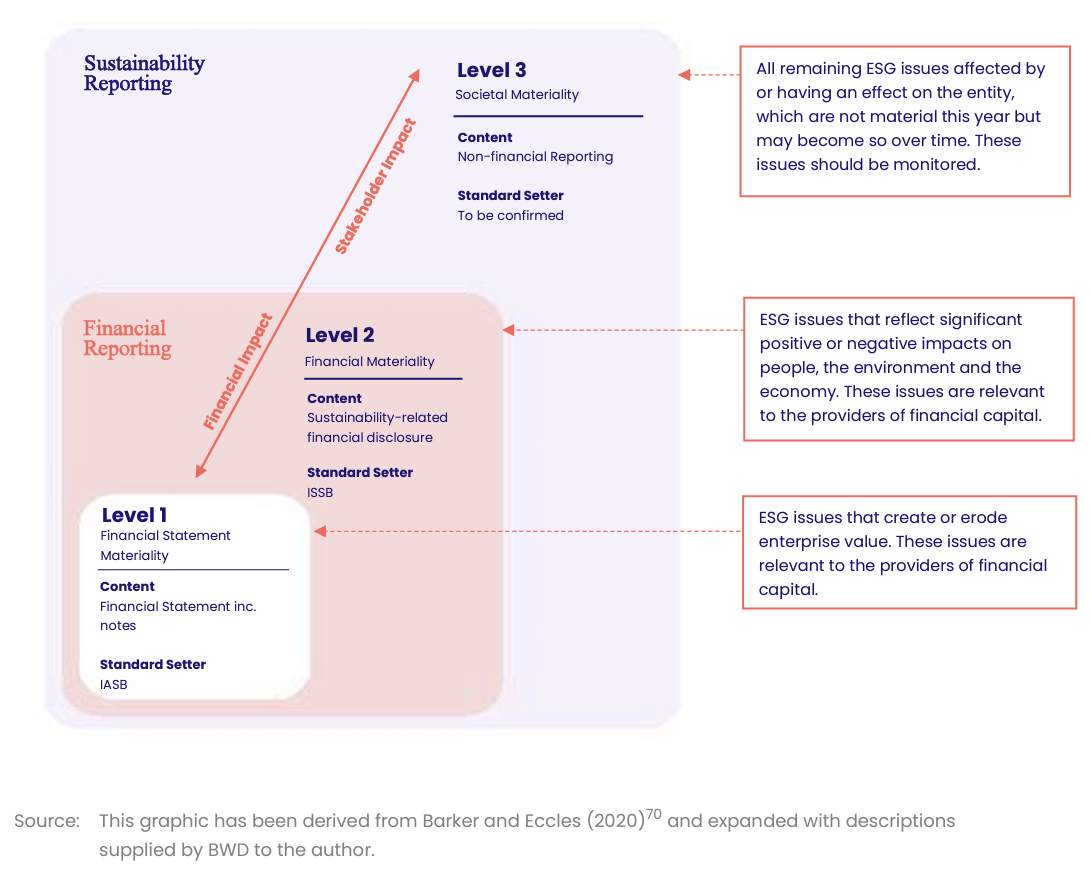

Inaugural and early whole-of-government sustainability reports should target financial market stakeholders, with governments devising a comprehensive reporting strategy to meet the needs of the broader stakeholder universe over time. This reflects the multiple levels of reporting that entities can undertake to address materiality (financial, societal) issues relevant to distinct stakeholders (See Figure 1). This is also consistent with the “building block” approach recommended by the International Federation of Accountants (IFAC) which advocates for investor-focused reporting in the first stage and then multi-stakeholder reporting once more mature. In the public sector, this could entail using distinct reporting products (e.g., intergenerational reports, agency annual reports), and formats (e.g., web-based communications that can be updated more regularly than annual reports) as opposed to broadening the objective and scope of the dedicated WoG sustainability report given the breadth and complexity of the stakeholder universe. The risk with the latter approach is in seeking to serve many stakeholders with distinct needs and objectives, a singular report serves none.

3) Sovereigns should prepare and publish a whole-of-government sustainability report through their treasuries, in close coordination with financing authorities

Investors in sovereign debt and ratings agencies are increasingly focused on issuer-level performance on ESG risks and issues. Investors have shifted emphasis from assets to issuers, broadening assessment to the issuer’s total profile. As sustainability lending and ESG methodologies in ratings agencies mature, governments are increasingly expected to articulate a coordinated WoG approach to ESG issues.

Much sustainability reporting and activity to date adopted a “climate first” approach, with the dominant interest from investors in the “E” dimension of ESG. This is now shifting as investors want to see credible track records across E, S and G. In addition, recent announcements by the ISSB emphasise the interconnected nature of sustainability matters; recognise that climate action is reliant on nature, biodiversity and a just transition; and identify priority projects for future sustainability standards covering (1) biodiversity, ecosystems and ecosystem services; (2) human capital; and (3) human rights. 7

All of these issues are crucial to the public sector. Accordingly, sovereigns are less able to point to individual assets – such as green or sustainable bonds – to establish credibility with investors, or individual programs and spending commitments to tackle chronic issues like climate change and intergenerational poverty. Instead, they need to demonstrate a coordinated program of action or overarching framework for managing ESG issues and their impacts on the balance sheet, economy, budget, communities and the environment.

In recognition of market participants’ needs, sovereigns should develop a WoG sustainability report, rather than simply devolve to agency-level reporting. Treasuries are best placed to assume responsibility for such products given their typical responsibilities include:

- financial and non-financial reporting for the public sector

- central agency cross-sector coordination

- mandates and frameworks that govern jurisdictional financing authorities for the purposes of government borrowing and investment and

- state-wide financial risks to sovereign balance sheets.

Treasury teams should closely collaborate with financing authorities, leveraging their capital market and investor knowledge to design and customise reporting products for their particular stakeholder audience.

Figure 1. Levels of sustainability reporting, with standard setters and materiality 8

Key concepts in sustainability reporting and disclosure in the public sector context

This report uses three related but distinct concepts: Sustainability, ESG and Sustainable Finance. These terms are not specific to the public sector. The precise meaning of each is contested, as different countries and organisations use these terms inconsistently and there are few standard definitions. The ISSB is attempting to resolve this confusion, by issuing guidance in December 2022 which included a definition of sustainability, adopted here with minor modification to make it more applicable to public sector entities. In this report, sustainability and ESG are used interchangeably, even though sustainability is a broader concept than ESG.

Sustainability

The ability for an organisation to sustainably maintain resources and relationships and manage its dependencies and impacts within its whole ecosystem over the short, medium and long term. Sustainability is a condition for an organisation to access over time the resources and relationships needed (such as financial, human, and natural), ensuring their proper preservation, development and regeneration, to achieve its goals.

ESG

ESG stands for environmental, social and governance factors. ESG analysis can be used to evaluate companies and issuers (sovereigns, sub-sovereigns, corporates) on how advanced they are with sustainability objectives. ESG factors had their origin in the investment industry and can be used to support sustainable investment activities. When applied to governments, they can mean the following:

- Environmental factors include the environmental footprint of a country/state, (e.g., contribution governments make to climate change through greenhouse gas emissions, decarbonisation), waste management, energy efficiency, biodiversity and natural capital.

- Social factors cover how governments interact with their employees and the communities they govern. This includes, but is not limited to worker rights, safety, diversity, education, labour relations, supply chain standards, community relations, and human rights as well as supply chain resilience.

- Governance factors include the institutional stability and strength of the system of government, as well as the effectiveness of the public service in maintaining accountability and transparency.

Sustainable finance

There are narrow and broad definitions of sustainable finance. Given governments’ mission to invest in public services and promote social and environmental outcomes, a broader definition is appropriate for public sector reporting. The Swiss Sustainable Finance organisation defines sustainable finance as: “Any form of financial activity integrating Environment, Social or Governance (ESG) considerations into a business or investment decision for the lasting benefit of customers, stakeholders and society at large.” 9

Sustainability reporting

Sustainability reporting is the act of communicating financial and non-financial information about ESG risks, opportunities and policies of an organisation, and the impact these policies have on both internal performance and wider society. For governments, this can mean reporting on the sustainability impacts and exposure of the government, through its direct operations, or the collective exposure of the economy and society over which a government holds sway. Sustainability reporting can include both sustainability-related financial disclosures and non-financial reporting of the reporting entity’s impact on the sustainability of systems within which it operates (e.g., the planet, society, communities). These different levels of reporting are governed by different standards and sometimes target different formats for communication e.g., integrated reporting in the annual report or separately, in a dedicated sustainability report.

Sustainability disclosure

Disclosure is a narrower concept that combines identification of a sustainability impact with public reporting of its financial impact.